Introduction to Financial Markets

- Welcome! Begin your journey into the world of financial markets with hands-on simulations and interactive learning.

- Key Concepts Explored:

- Stocks, bonds, risk, return, diversification, and trading strategy

- Simulation Experience:

- Use MarketSim to make real-time decisions with virtual money

- Apply each concept through practical scenarios and portfolio management

- Reflection: Complete a portfolio project to reinforce your learning and track your progress.

- Diagram: Visualize the relationship between stocks, bonds, and portfolio growth using a simple flowchart.

Learning Goals

- Key Terms: Define stock, bond, dividend, risk, and return.

- Market Forces: Explain how supply and demand influence price movements in real markets.

- Math Skills: Calculate returns using basic formulas and understand the impact of gains and losses.

- Diversification: Build a portfolio that spreads risk across multiple assets and sectors.

- Strategy Comparison: Evaluate the pros and cons of long-term versus short-term investment approaches.

- Diagram: Use a concept map to connect each learning goal to practical trading scenarios.

Why Learn About Markets?

- Life Impact: Financial decisions influence your future opportunities, security, and well-being.

- Economic Role: Markets provide capital for innovation, business growth, and job creation.

- Protection: Financial literacy helps you avoid scams, make informed choices, and recognize risks.

- Safe Practice: Simulations let you experience real market volatility without risking real money.

- Empowerment: Gain confidence to manage your own investments and financial future.

- Diagram: Flowchart showing how financial education leads to smarter decisions and better outcomes.

What Is a Stock Market?

- Definition: A stock market is a public marketplace for buying and selling shares of companies.

- Participants: Investors, traders, and institutions interact to set prices through supply and demand.

- Examples: New York Stock Exchange (NYSE), NASDAQ.

- Function: Facilitates capital raising for companies and investment opportunities for individuals.

- Diagram: Simple diagram: investors ⇄ stock market ⇄ companies.

- Key Point: Prices change constantly as buyers and sellers agree on value.

Meet MarketSim

- Virtual Trading Platform: Practice trading with $100,000 in simulated cash.

- Real-Time Data: Experience live market dynamics with prices updated every few seconds (slight delay).

- Leaderboards: Compete with classmates and track your progress on the leaderboard.

- Safe Environment: Make mistakes, test strategies, and learn—no real money is at risk.

- Features:

- Buy and sell stocks and bonds

- Monitor portfolio performance

- Access research tools and charts

- Diagram: Dashboard mockup showing portfolio, recent trades, and leaderboard.

What Is a Stock?

- Ownership: Each stock represents a partial ownership in a corporation.

- Rights: Stockholders may receive dividends, vote at annual meetings, and benefit from company growth.

- Value: Stock prices fluctuate based on company performance and market conditions.

- Types: Common vs. preferred stock—different rights and priorities.

- Diagram: Pie chart showing how stockholders own a piece of the company.

- Key Point: Stocks are a primary way to build long-term wealth.

Dividends

- Definition: Dividends are cash payments distributed from company profits to shareholders.

- Frequency: Usually paid quarterly, but can vary by company.

- Purpose: Provide income in addition to potential stock price appreciation.

- Eligibility: Must own the stock before the ex-dividend date to receive payment.

- Diagram: Timeline showing announcement, ex-dividend, record, and payment dates.

- Key Point: Not all companies pay dividends; some reinvest profits for growth.

Ticker Symbols

- Definition: Unique short codes (e.g., AAPL, MSFT) assigned to publicly traded companies.

- Usage: Enter ticker symbols in MarketSim and real trading platforms to research or place trades.

- Examples: AAPL (Apple), TSLA (Tesla), GOOGL (Alphabet).

- Purpose: Quickly identify and track stocks across exchanges.

- Diagram: Table showing company names and their ticker symbols.

- Key Point: Always double-check the ticker before trading to avoid mistakes.

Your Portfolio

- Definition: Your portfolio is the total collection of stocks, bonds, and cash you own.

- Value Fluctuations: Portfolio value changes as market prices rise or fall.

- Components:

- Stocks: Ownership in companies

- Bonds: Loans to companies/governments

- Cash: Uninvested funds

- Goal: Grow your portfolio over time while managing risk.

- Diagram: Pie chart illustrating portfolio allocation.

- Key Point: Diversification helps reduce risk and smooth returns.

What Is a Bond?

- Definition: A bond is a loan you provide to a company or government in exchange for regular interest payments.

- Interest: Bonds pay fixed or variable interest, called the coupon rate.

- Risk Level: Generally less risky than stocks, but not risk-free.

- Types: Corporate bonds, municipal bonds, government (Treasury) bonds.

- Diagram: Timeline showing bond issue, interest payments, and maturity.

- Key Point: Bonds help balance risk in a diversified portfolio.

Stocks vs Bonds

- Stocks:

- Represent ownership in a company

- Potential for high returns through price appreciation and dividends

- Higher risk due to market volatility and company performance

- Bonds:

- Loans to companies or governments

- Provide steady interest income (coupon payments)

- Generally lower risk than stocks, but not risk-free

- Key Comparison: Stocks offer growth potential, bonds offer stability. Most portfolios use both for balance.

- Diagram: Table comparing features: ownership, risk, return, income, and volatility.

Why Invest in Stocks?

- Growth Potential: Stocks historically offer higher long-term returns than most other investments.

- Dividend Income: Many companies pay dividends, providing regular income.

- Liquidity: Stocks can be bought and sold quickly on public exchanges.

- Ownership: Shareholders may vote on company decisions and benefit from company success.

- Risks: Stock prices can be volatile; patience and long-term perspective are essential.

- Diagram: Line graph showing long-term stock market growth with short-term fluctuations.

Why Invest in Bonds?

- Income: Bonds provide regular interest payments, helping to stabilize your portfolio.

- Capital Preservation: Bonds typically return principal at maturity, protecting your initial investment.

- Diversification: Bonds often move differently from stocks, reducing overall risk.

- Risk Reduction: Adding bonds to a portfolio can cushion losses during stock market downturns.

- Diagram: Pie chart showing a balanced portfolio with both stocks and bonds.

- Key Point: Bonds are essential for conservative investors and those nearing financial goals.

Supply & Demand Basics

- Core Principle: Prices are set by the balance of buyers (demand) and sellers (supply).

- Price Increases: When demand is greater than supply, prices rise.

- Price Decreases: When supply is greater than demand, prices fall.

- Market Example: Earnings reports, news, and trends can shift demand or supply quickly.

- Diagram: Supply and demand curves intersecting at equilibrium price.

- Key Point: Understanding supply and demand helps explain why prices move in financial markets.

Market Equilibrium

- Definition: The point where supply and demand are balanced and prices stabilize.

- Adjustment: Markets naturally move toward equilibrium as buyers and sellers react to price changes.

- Example: If prices are too high, demand falls and supply rises, pushing prices down to equilibrium.

- Diagram: Graph showing equilibrium price at the intersection of supply and demand curves.

- Key Point: Equilibrium is dynamic—constantly shifting with market news, events, and investor sentiment.

News Moves Markets

- Impact: News events can quickly change investor sentiment and market direction.

- Types of News:

- Earnings reports

- Product launches

- Economic data releases

- Crises or scandals

- Price Reaction: Positive news increases demand, negative news increases supply.

- Diagram: Timeline showing a news event and resulting price spike or drop.

- Key Point: Stay informed—news can create both risks and opportunities.

Scenario: Good News

- Example: Company beats earnings expectations or announces a breakthrough product.

- Market Reaction: Demand for shares increases, pushing prices higher.

- Decision Point: Consider buying before the news is widely known, but be cautious of hype.

- Risks: Prices can overreact and later correct.

- Diagram: Price chart with a spike after a news event.

- Strategy: Weigh the news against your investment plan before acting.

Result

- Opportunity: Early buyers may profit as prices rise on good news.

- Verification: Always confirm the accuracy of news before trading.

- Risks: Acting on rumors or incomplete information can lead to losses.

- Diagram: Timeline showing news release, price jump, and possible correction.

- Key Point: Evidence-based investing is safer than chasing rumors.

Scenario: Bad News

- Example: Negative events like scandals, data breaches, or poor earnings reports.

- Market Reaction: Selling pressure increases, causing prices to fall.

- Decision Point: Consider whether to sell, hold, or buy at a discount.

- Risks: Panic selling can lock in losses; careful analysis is needed.

- Diagram: Price chart showing a sharp drop after bad news.

- Strategy: Evaluate fundamentals before making a decision.

Result

- Panic Selling: Can drive prices lower than justified by fundamentals.

- Informed Response: Analyze the underlying cause—temporary setback or lasting impact?

- Opportunity: Sometimes bad news creates buying opportunities for patient investors.

- Diagram: Chart showing overreaction and gradual recovery.

- Key Point: Avoid emotional decisions; use analysis and a long-term view.

Risk & Return

- Trade-Off: Higher returns usually come with higher risk.

- Types of Risk: Market risk, company risk, interest rate risk, inflation risk, and more.

- Reward: Potential for gains increases with risk, but so does the chance of loss.

- Managing Risk: Diversification and research can help control risk.

- Diagram: Risk-return graph showing upward-sloping curve.

- Key Point: Decide your risk tolerance before investing.

Risk-Return Curve

- Visual Guide: Shows how different investments offer varying risk and return.

- Low Risk/Low Return: Savings accounts, government bonds.

- Medium Risk/Medium Return: Corporate bonds, blue-chip stocks.

- High Risk/High Return: Growth stocks, venture capital.

- Diagram: Curve plotting risk on x-axis and return on y-axis, with asset classes labeled.

- Key Point: Choose investments that match your goals and comfort with risk.

Quick Calculation

- Example: Buy 5 shares at $20 each, sell at $25 each.

- Profit Calculation: (Sell price - Buy price) x Number of shares = ($25 - $20) x 5 = $25.

- Return %: (Profit ÷ Cost) x 100 = ($25 ÷ $100) x 100 = 25%.

- Diagram: Step-by-step calculation flowchart.

- Key Point: Understanding returns helps you compare investments.

Answer

- Formula: Return % = (Profit ÷ Cost) x 100.

- Worked Example: Profit = $25; Cost = $100; Return = 25%.

- Application: Use this formula for any buy/sell scenario.

- Diagram: Calculation box with inputs and outputs labeled.

- Key Point: Accurate return calculations are essential for tracking performance.

Diversification

- Definition: Diversification means spreading investments across different assets to reduce risk.

- Benefit: Limits the impact of a poor-performing investment on your overall portfolio.

- How: Invest in various sectors, asset classes, and geographic regions.

- Diagram: Pie chart showing diversified vs. concentrated portfolios.

- Key Point: Diversification is a key strategy for long-term success.

Diversify by Sector

- Sector Examples: Technology, Healthcare, Finance, Energy, Retail, Industrials, Utilities.

- Why Diversify? Different sectors react differently to economic changes.

- Strategy: Allocate funds across multiple sectors to smooth returns and lower risk.

- Diagram: Bar chart comparing sector returns in different market cycles.

- Key Point: Sector diversification helps manage risk from economic shifts.

Portfolio Pie Example

- Visualization: Pie charts show portfolio allocation by asset or sector.

- Risk Management: No single holding should dominate your portfolio.

- Adjustments: Rebalance periodically to maintain desired allocation.

- Diagram: Example pie chart with labeled slices for each holding.

- Key Point: Visual tools make it easier to spot imbalances and improve diversification.

Quiz: Who’s Safer?

- Scenario: Compare risk of holding one stock vs. a diversified five-sector portfolio.

- Discussion: What happens if your single stock drops in value?

- Lesson: Diversification reduces the risk of large losses from one holding.

- Diagram: Risk meter comparing single vs. diversified portfolios.

- Key Point: More holdings in different sectors usually means lower risk.

Answer

- Explanation: A diversified portfolio spreads risk across sectors, reducing the impact of one underperformer.

- Benefit: Smoother returns and less stress during market swings.

- Diagram: Line chart showing volatility of single vs. multi-sector portfolios.

- Key Point: Diversification is a proven way to manage investment risk.

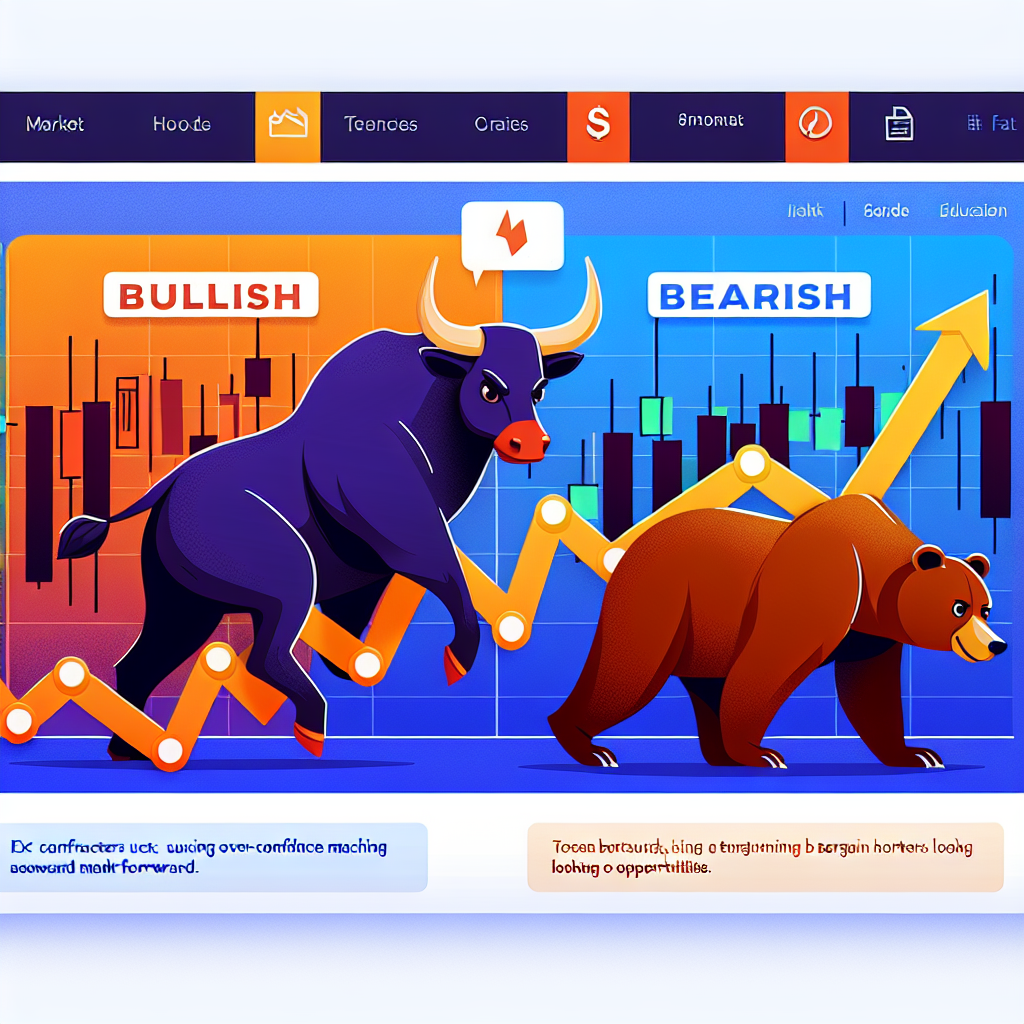

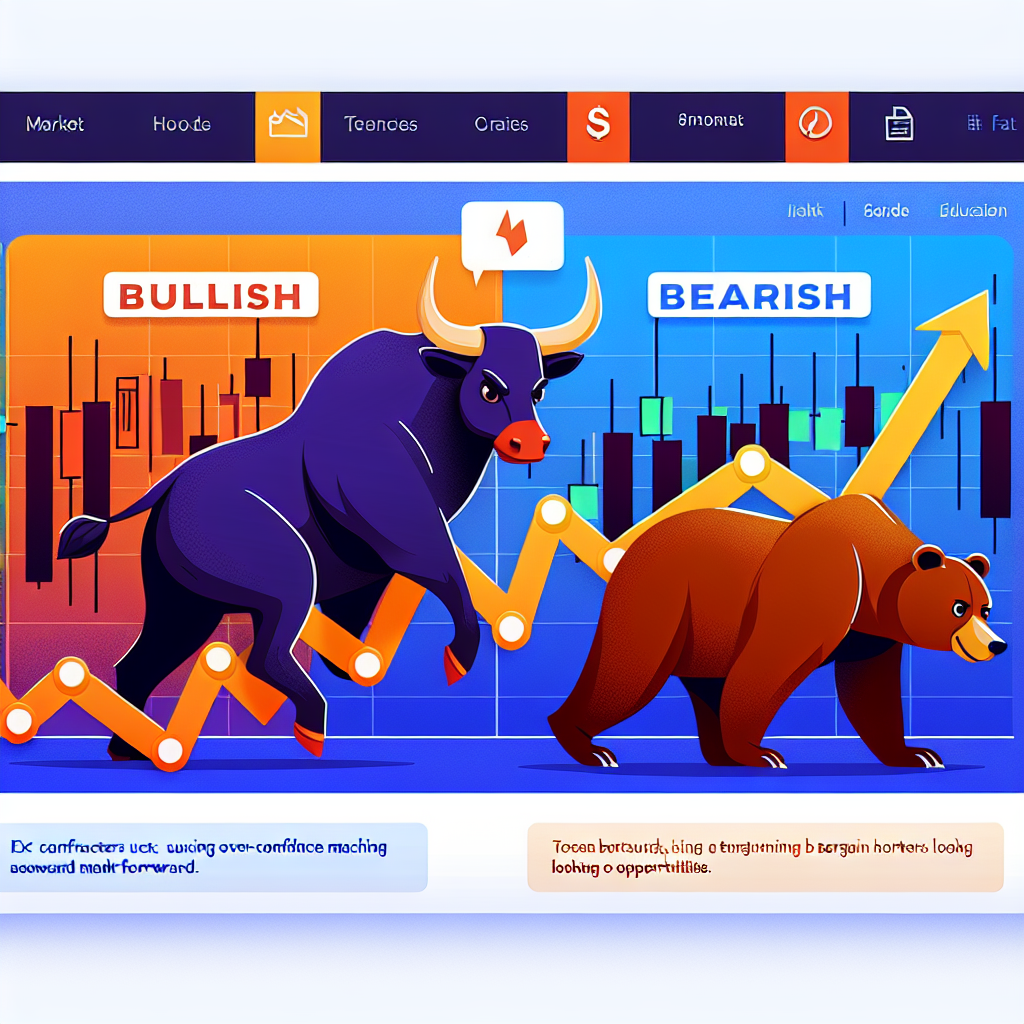

Bull vs Bear

- Bull Market: Period of rising prices and optimism.

- Bear Market: Period of falling prices and pessimism.

- Cycle: Markets alternate between bull and bear phases.

- Strategy: Adapt your approach to the current market environment.

- Diagram: Market cycle graph showing bull and bear phases.

- Key Point: Both types of markets are natural and offer opportunities.

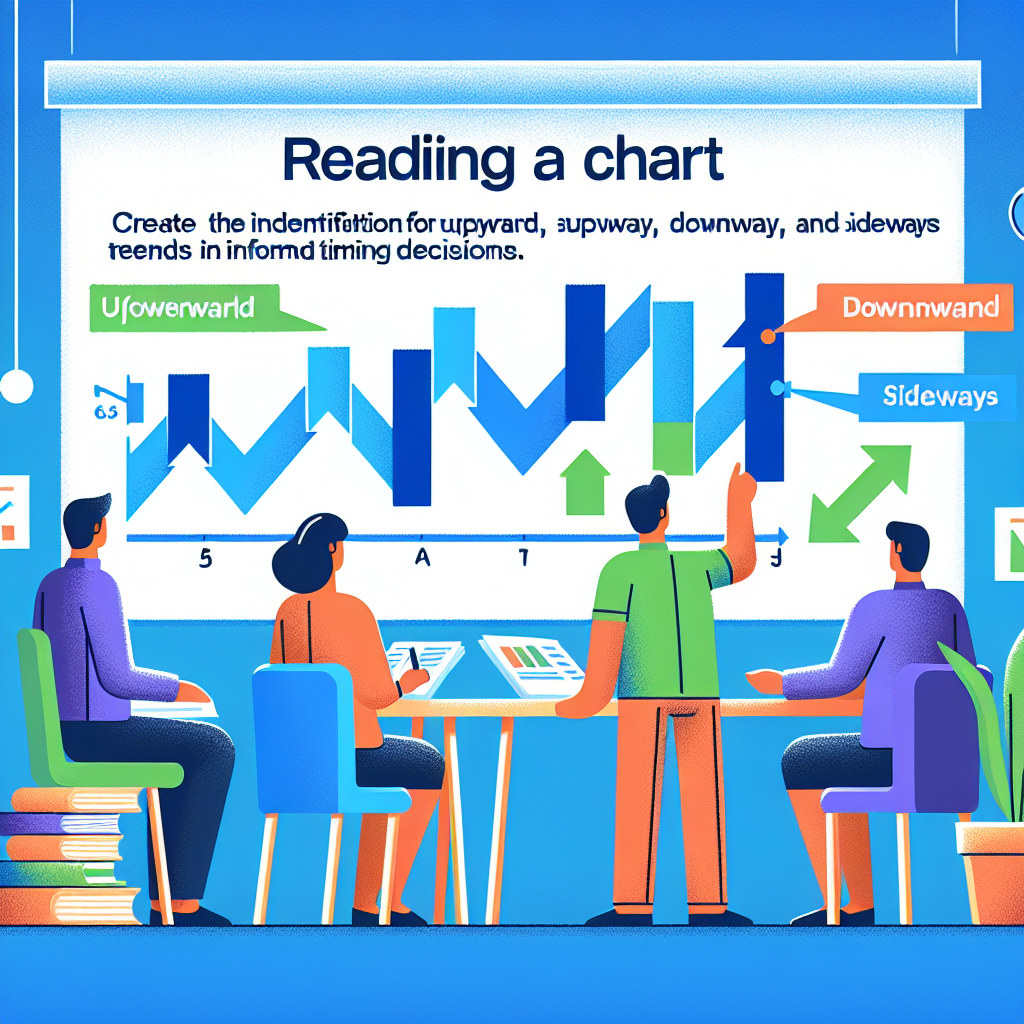

Reading a Chart

- Trend Identification: Spot upward, downward, and sideways trends using price charts.

- Tools: Moving averages, support/resistance lines, and volume indicators.

- Timing: Use trends to guide entry and exit decisions.

- Diagram: Annotated chart showing different trend types.

- Key Point: Chart reading is a valuable skill for all investors.

Trend Analysis

- Bull Trends: Rising prices can lead to overconfidence and risky bets.

- Bear Trends: Falling prices may offer bargains, but also risk catching a falling knife.

- Analysis: Look for confirmation before acting on trends.

- Diagram: Chart with trend lines and entry/exit points marked.

- Key Point: Understanding trends helps avoid emotional mistakes.

Long-Term Strategy

- Buy and Hold: Invest in strong companies and keep positions for years.

- Ignore Noise: Focus on fundamentals, not daily price swings.

- Benefits: Lower taxes, fewer commissions, compounding returns.

- Diagram: Growth chart showing value over time with less trading.

- Key Point: Patience and discipline are rewarded in the long run.

Short-Term Trading

- Active Approach: Make frequent trades based on news, momentum, and technical signals.

- Potential Rewards: Quick gains if predictions are correct.

- Risks: Higher transaction costs, taxes, and losses from bad timing.

- Diagram: Candlestick chart with rapid price movements.

- Key Point: Short-term trading is challenging and requires discipline.

Research First

- Preparation: Review charts, news, and financial metrics before making any trade.

- Sources: Use MarketSim, financial news sites, and company reports.

- Checklist:

- Company fundamentals

- Recent news

- Technical indicators

- Diagram: Flowchart of research steps before trading.

- Key Point: Informed decisions lead to better outcomes.

Trade Planning Sheet

- Plan Ahead: Write down your reason for the trade, target price, and risk tolerance.

- Details: Record ticker, number of shares, and stop-loss level.

- Review: Double-check your plan before placing the order.

- Diagram: Example planning sheet with fields for each detail.

- Key Point: Planning reduces emotional mistakes and improves discipline.

Executing a Trade

- Steps:

- Enter ticker symbol and number of shares

- Review estimated cost and available cash

- Confirm the order

- Check your portfolio for the new position

- Verification: Ensure order was filled at expected price.

- Diagram: Screenshot of order entry form.

- Key Point: Careful order entry prevents costly mistakes.

Good Reason or Hearsay?

- Fact-Checking: Only trade based on reliable, verified information.

- Risks: Acting on rumors or FOMO (fear of missing out) can lead to losses.

- Checklist: Confirm news from multiple sources before trading.

- Diagram: Decision tree: rumor vs. verified info.

- Key Point: Evidence-based trading produces more consistent results.

Answer

- Data-Driven: Use facts, analysis, and research—not just intuition.

- Benefits: Higher probability of success and more stable returns.

- Diagram: Chart comparing gut-based and data-based results.

- Key Point: Let evidence guide your investment decisions.

Key Terms Recap

- Stock: Ownership in a company

- Bond: Loan to a company or government

- Dividend: Profit sharing with shareholders

- Ticker: Unique code for a stock

- Portfolio: Collection of investments

- Bull/Bear: Market trends (up/down)

- Risk/Return: Trade-off between potential gain and loss

- Diversification: Spreading risk across assets

- Diagram: Glossary table with icons for each term.

Concept Toolkit

- Supply & Demand: Understand how prices are set.

- Risk-Return Curve: Choose investments that fit your comfort level.

- Diversification: Reduce risk by spreading investments.

- Strategy: Develop a plan before trading.

- Diagram: Toolkit graphic with icons for each concept.

- Key Point: Use these tools for every investment decision.

Reflective Journal

- Purpose of Trade: Note your motivation and goals for each trade you make.

- Market Context: Record market conditions and news influencing your decisions.

- Trade Execution: Log entry/exit points, position size, and timing.

- Outcomes: Track gains, losses, and unexpected events during the trade.

- Lessons Learned: Reflect on what worked, what didn't, and why.

- Strategy Adjustments: Identify improvements for future trades based on your reflections.

- Metacognitive Practice: Regular journaling helps develop discipline, self-awareness, and mastery in trading.

Simulation Event

- Interest Rate Shock: Observe how a sudden change in interest rates impacts different market sectors.

- Sector Reactions:

- Financials: Banks and lenders may benefit from rising rates.

- Utilities/Real Estate: Often negatively affected due to higher borrowing costs.

- Technology/Consumer Goods: Impact varies based on debt levels and growth outlook.

- Trading Strategy: Adjust positions based on sector performance and risk assessment.

- Key Takeaways: Recognize the interconnectedness of economic events and portfolio management.

- Diagram: Draw a flowchart linking interest rate change → sector impact → portfolio adjustment.

Monitor Your Portfolio

- Daily Review Checklist:

- Track gains and losses for each holding.

- Monitor overall portfolio value and cash balance.

- Check for proper diversification across sectors and asset classes.

- Risk Management: Set stop-losses and review position sizes.

- Avoid Over-Trading: Trade only when your strategy signals, not out of boredom or emotion.

- Performance Analysis: Compare results to benchmarks and your goals.

- Diagram: Use a pie chart to visualize portfolio allocation and a line chart for daily balance trends.

Class Discussion

- Rationale Sharing: Present your trade decisions and the reasoning behind them.

- Outcome Review: Discuss what happened and compare to expectations.

- Peer Feedback: Listen to classmates' perspectives and alternative strategies.

- Collaborative Learning: Identify patterns, mistakes, and successes as a group.

- Growth Mindset: Use constructive criticism to improve future performance.

- Diagram: Consider using a mind map to capture diverse strategies and lessons learned during the discussion.

Ethical Investing

- Legal Standards: Insider trading is illegal and undermines market trust.

- Transparency: Honest reporting and disclosure are essential for fair markets.

- Social Responsibility: Consider environmental, social, and governance (ESG) factors.

- Long-Term Value: Ethical investing can support sustainable returns and positive change.

- Diagram: Scales balancing profit and ethics.

- Key Point: Integrity and fairness benefit everyone in the market.

Summary

- Knowledge Gained: You understand stocks, bonds, risk, return, and diversification.

- Skills Practiced: Simulated trading, research, and portfolio management.

- Decision Tools: Use your toolkit for real and virtual investing.

- Next Steps: Apply what you’ve learned in MarketSim and beyond.

- Diagram: Flowchart summarizing the learning journey.

- Key Point: You are ready to confidently navigate financial markets.

Your Action Plan

- Set Goals: Define your growth targets, risk tolerance, and diversification objectives.

- Plan: Develop a clear investment plan with timelines and benchmarks.

- Execute: Take action in MarketSim and track your progress.

- Review: Regularly assess your results and adjust as needed.

- Diagram: Checklist or roadmap graphic for your action plan.

- Key Point: Success comes from planning, action, and reflection.

First Trades Today

- Get Started: Log in to MarketSim and access your virtual portfolio.

- Research: Select two companies to investigate using charts and news.

- Plan: Complete trade planning sheets for each company.

- Trade: Place your first buy orders and monitor execution.

- Diagram: Checklist with steps for your first trades.

- Key Point: The best way to learn is by doing—start now!

Ready to Launch!

- Congratulations! You’ve completed the introduction to financial markets.

- Next Steps: Continue learning, practicing, and refining your skills in MarketSim.

- Iterate: Learn from successes and mistakes—every trade is a lesson.

- Confidence: Build financial knowledge for a lifetime of smart decisions.

- Diagram: Rocket or upward arrow symbolizing growth and achievement.

- Key Point: Stay curious, keep learning, and enjoy your financial journey!